Considering a reverse mortgage? Perhaps to shore up your budget or raise funds for a big purchase? Stop and save yourself from financial ruin. Contrary to statements in ads, reverse mortgages do not provide any income and they bring on new ways…

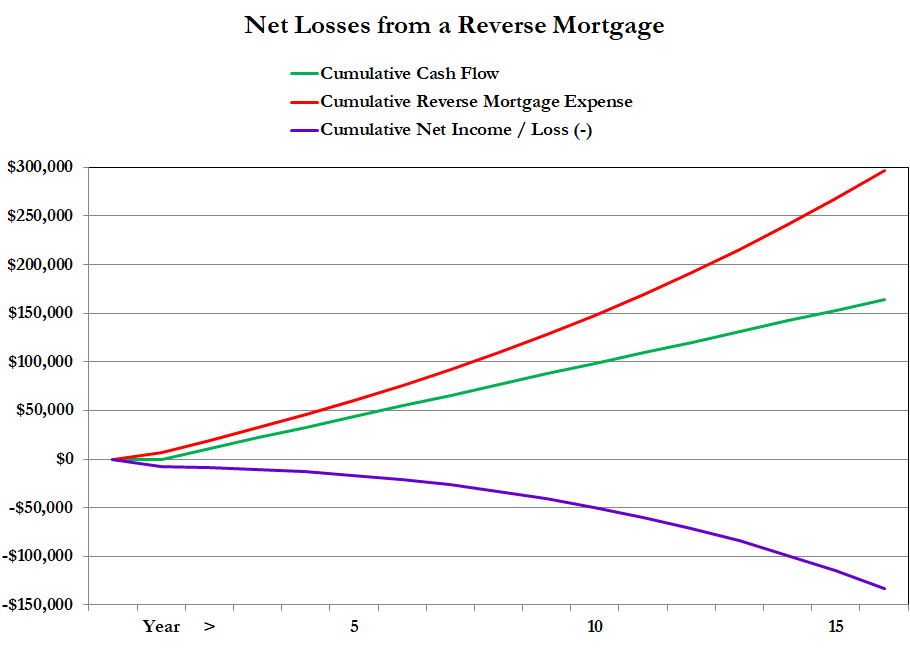

Many deceitful institutions use the word income when referring to the cash flow from reverse mortgages. Such phrasing is an outright lie.

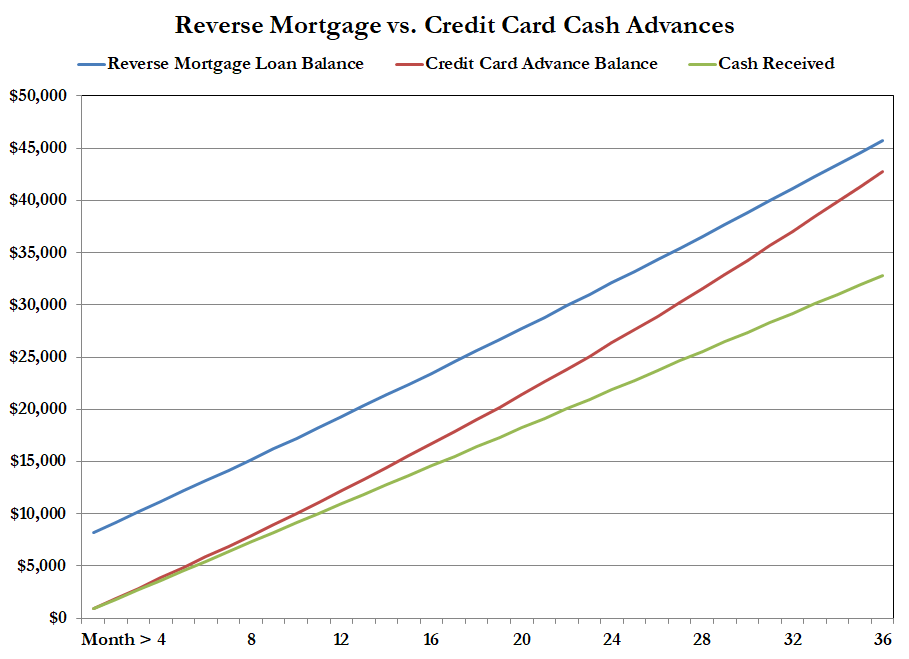

Credit card cash advances are widely known to be horrifically expensive means to borrow money.

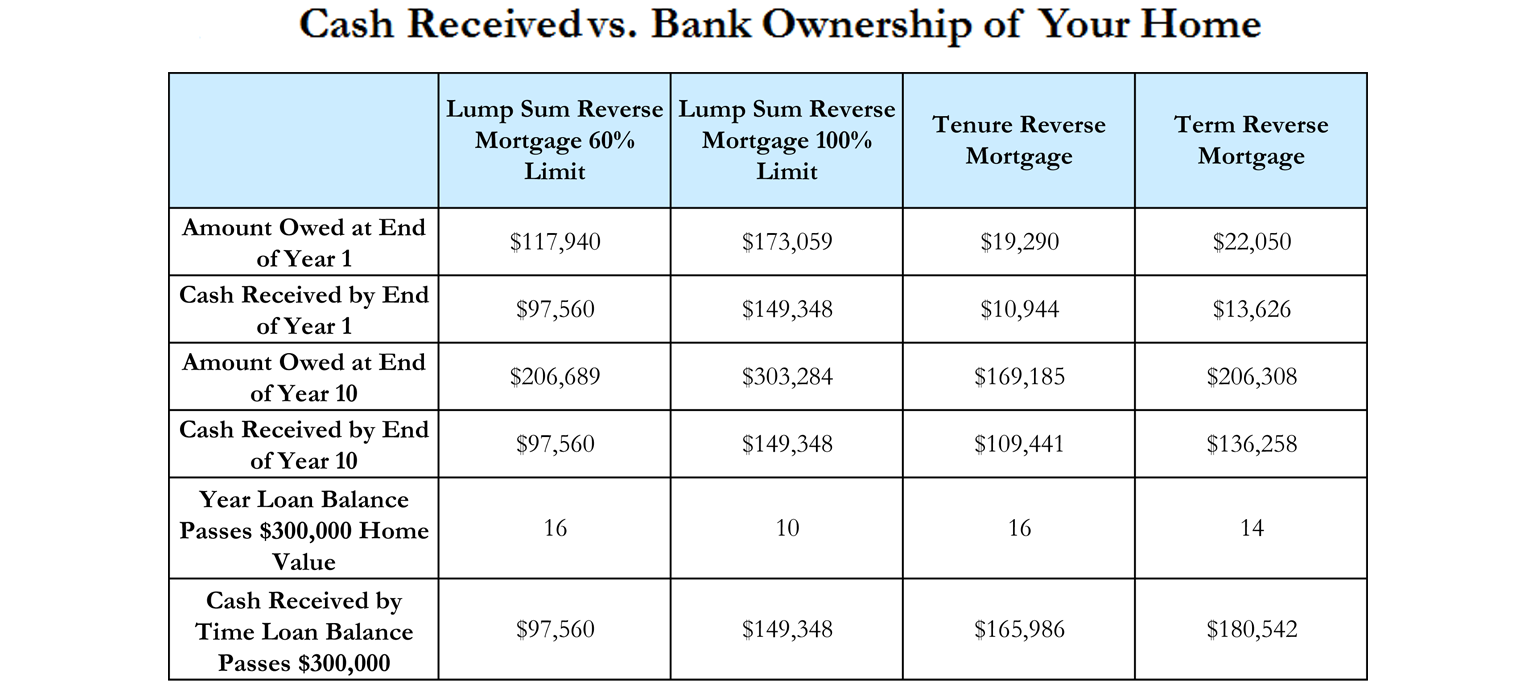

The maximum amount of money you can receive via a reverse mortgage is some fraction of your home’s worth. Depending on interest rates a 62-year old might get between 13% and 52% of the home’s value, minus closing costs.

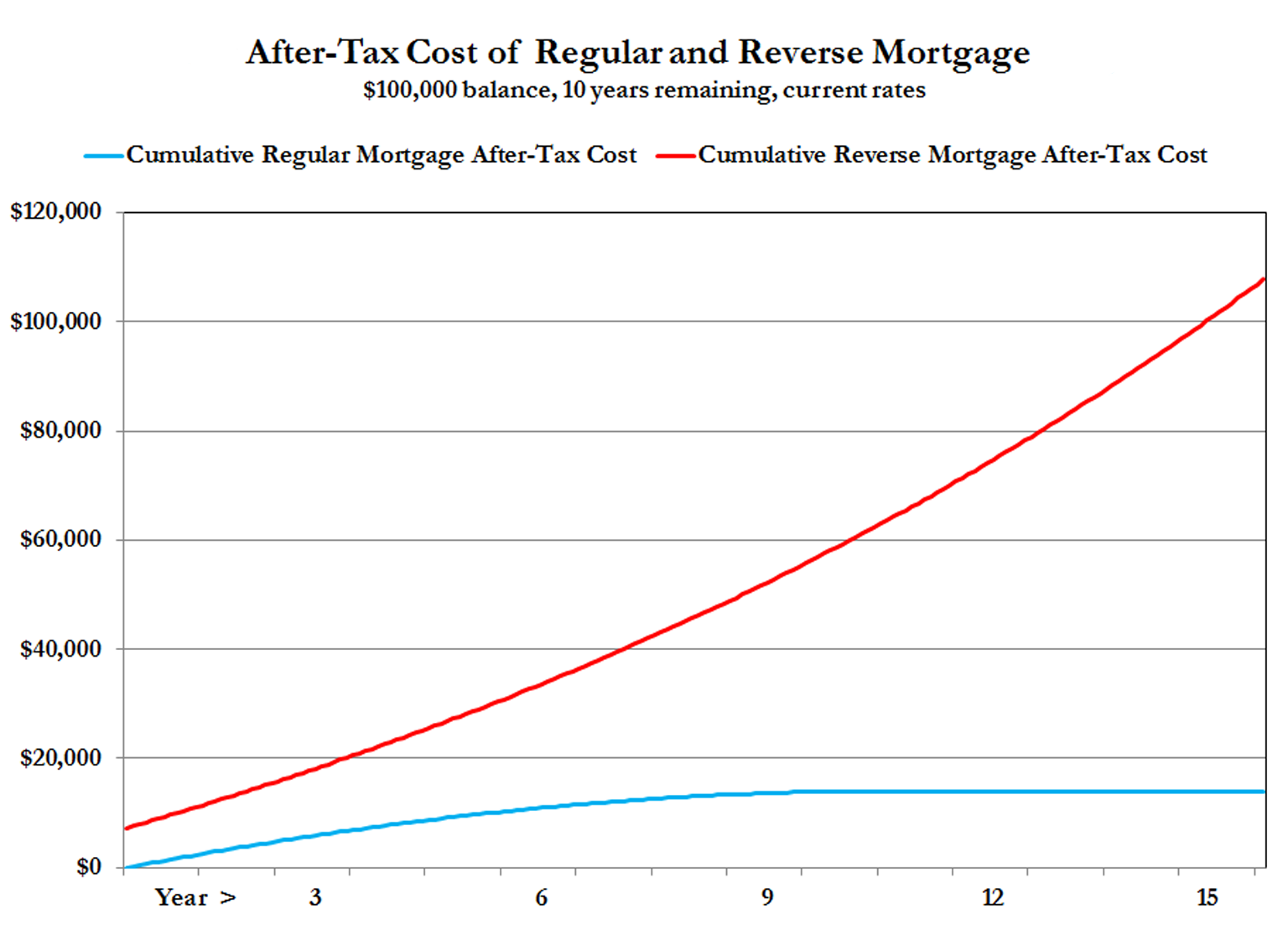

Some of the vilest companies promote the use of reverse mortgages to pay off an existing regular mortgage.

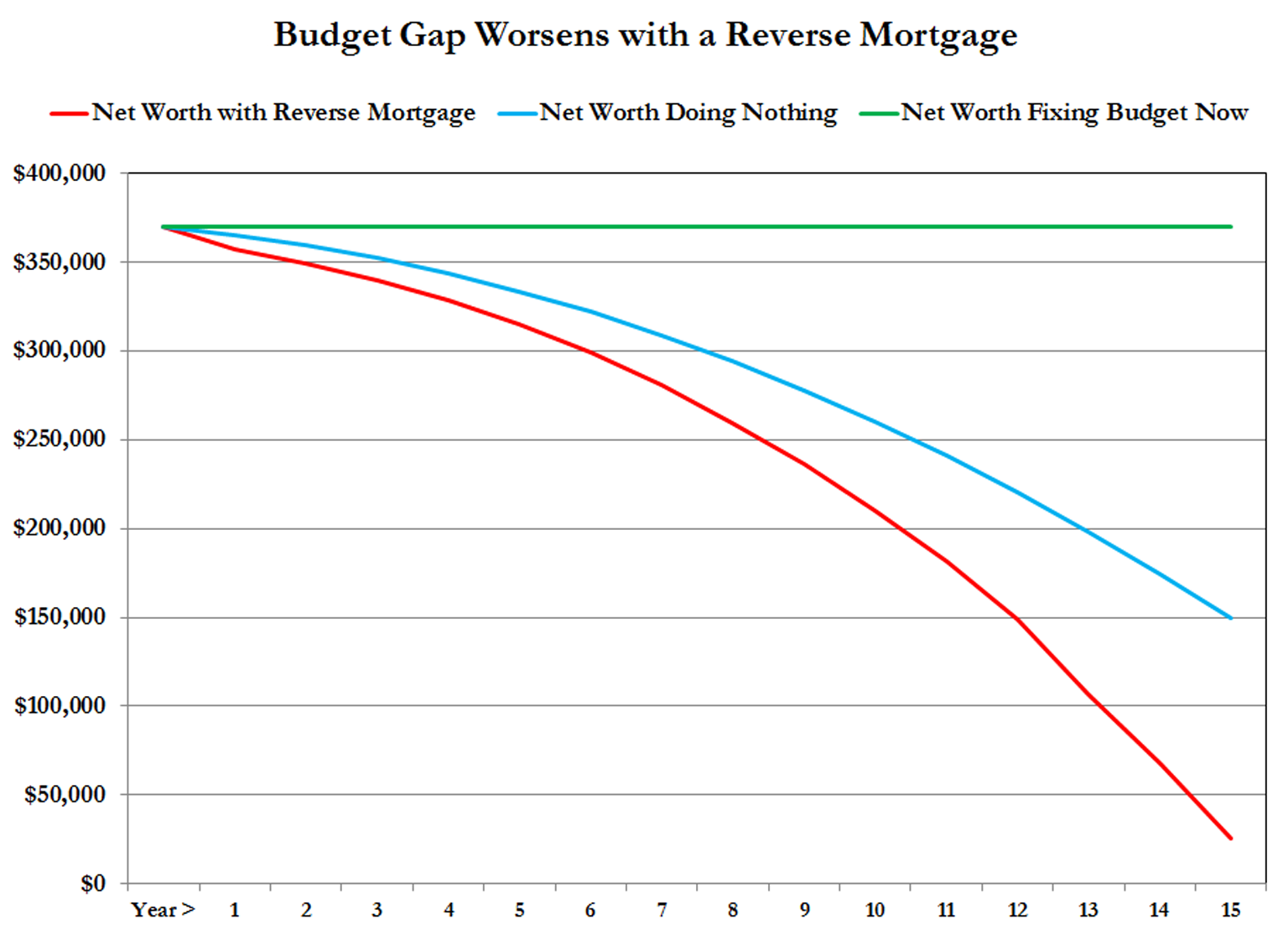

A seemingly rational sounding excuse to get a reverse mortgage is to maintain your standard of living; to stem negative cash flow. Since costs for the elderly often rise faster than retirement income sources, budgetary shortfalls are becoming increasingly common. In this…

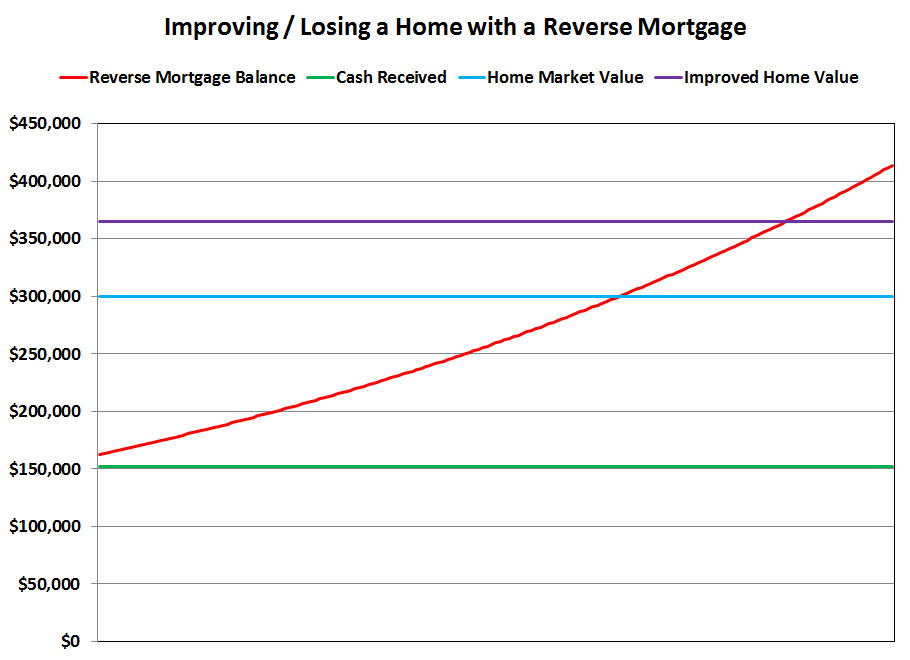

If you want to make a major home improvement and can afford it, do it. If you are still working or otherwise have means to pay back a home equity loan needed to make a desired home improvement, it is worthy of…

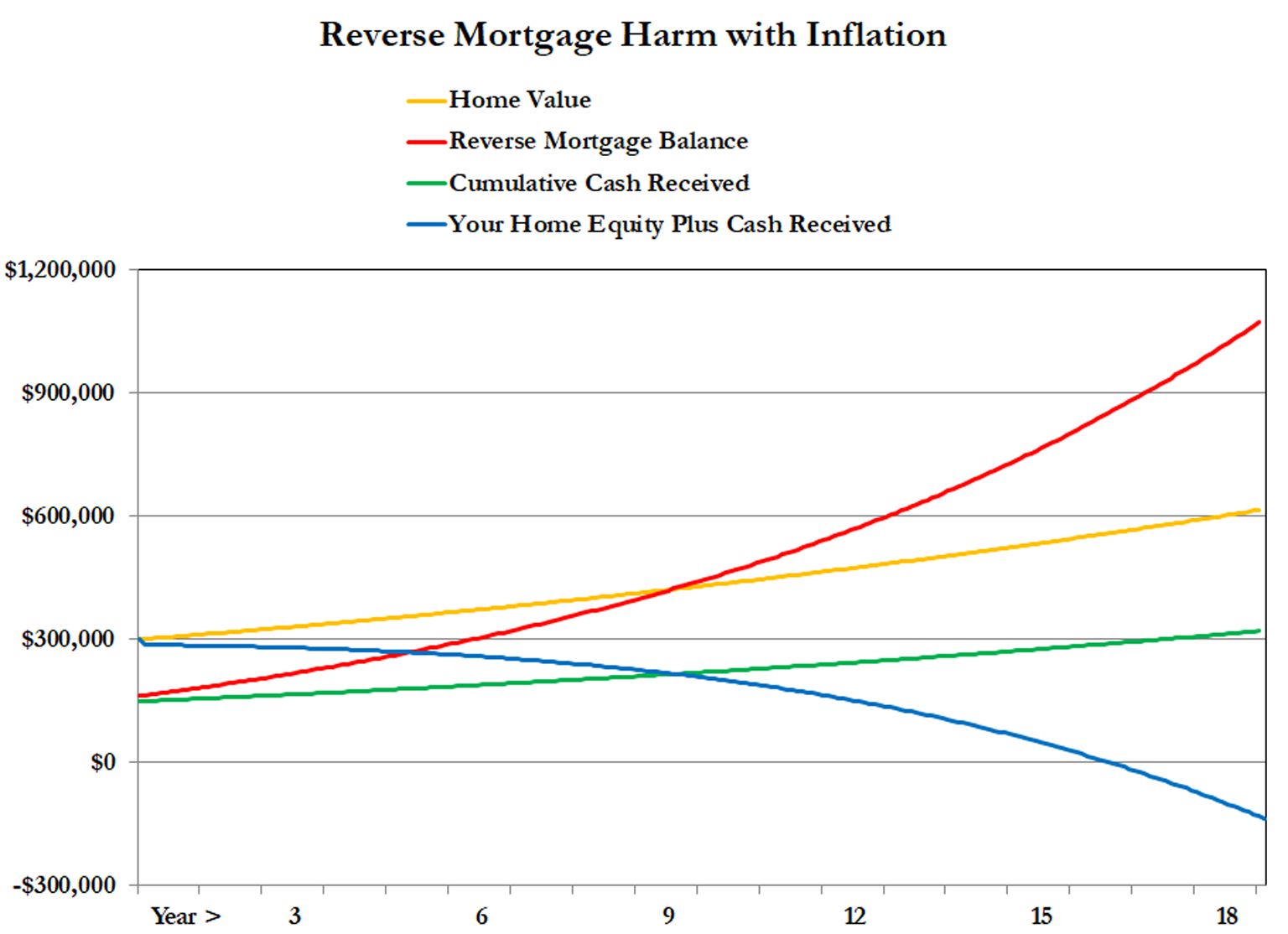

For simplicity, the examples used in the other posts in this blog assume no home appreciation and no change in interest rates. A conniving salesperson might attempt